10 Simple Techniques For Estate Planning Attorney

Table of ContentsEstate Planning Attorney Can Be Fun For Everyone3 Simple Techniques For Estate Planning AttorneySome Known Incorrect Statements About Estate Planning Attorney The Estate Planning Attorney PDFs

Finding a probate attorney that's familiar with a judge's choices can make the process a great deal smoother. "Just how long do you estimate my situation will take prior to the estate will be worked out?

"What are your charges?"Ensure you have a concrete understanding regarding costs. Will he or she bill a level rate? A percent based on the estate value? Hourly? Whether to employ a probate attorney relies on a range of aspects. You wish to think about just how comfy you are browsing probate, how challenging your state regulations are and exactly how large or comprehensive the estate itself is.

Unknown Facts About Estate Planning Attorney

But those situations can be avoided when you're properly secured. Luckily, Trust & Will is below to assist with any kind of and all of your estate preparing needs. Unsure whether a Will or Trust fund is appropriate for you? Take our simple quiz developed to help recognize your best plan.

Strategies for estates can evolve. Adjustments in assets, health, separation, and even vacating state ought to all be made up when updating your estate plan. A depend on attorney can aid to update your depend on terms as proper. The attorneys will certainly resolve trust fund disputes, look after circulations and safeguard your passions and goals also long after your death.

These counts on are beneficial for a person who is either young or financially careless. : Setting up a QTIP (Certified Terminable Interest Building Count on) will certainly make certain that income from the Depend on would certainly be paid to your making it through partner if you die. The continuing to be funds would be kept in the original Depend on, and after the partner dies, the money mosts likely to your recipients.

The Definitive Guide to Estate Planning Attorney

Your properties are overlooked to your grandchildren, which means they are absolved from estate taxes that could have been set off if the inheritance went to your children. Noted below are methods in which a depend on can make your estate intending a substantial success.: Probate is usually also taxing and generally takes a year or even more to finish.

Lawyer charges and court expenses can account for as much as 5 % of the value of an estate. Trust funds can aid you to resolve your estate swiftly and effectively. Possessions in a count on are invested under the principles of Prudent Investment-these can allow them to expand enormously now and after your death.

The probate procedure is public. Hence, when your estate is provided for probate, your will, business, and financial details ended up being public record, exposing your enjoyed ones to haters, scammers, thieves, and destructive district attorneys. The private and confidential nature of a trust fund is the opposite.: A depend on safeguards your assets from legal he has a good point actions, lenders, divorce, and various other overwhelming challenges.

Getting The Estate Planning Attorney To Work

As protecting the rate of interests of a small child, a trust fund can establish standards for circulation. Offer dependents also when you are dead: Youngsters and adults with unique needs may profit from an unique requirements trust fund that offers their clinical and individual needs. Furthermore, it makes certain that you remain eligible for Medicare advantages.

An independent trustee can be selected if you assume your recipients could not handle their assets wisely - Estate Planning Attorney. You can also set usage limitations. For instance, it can specify in the Trust fund that property circulations might just be made to recipients for their well-being requires, such as acquiring a home or paying clinical costs and except fancy autos.

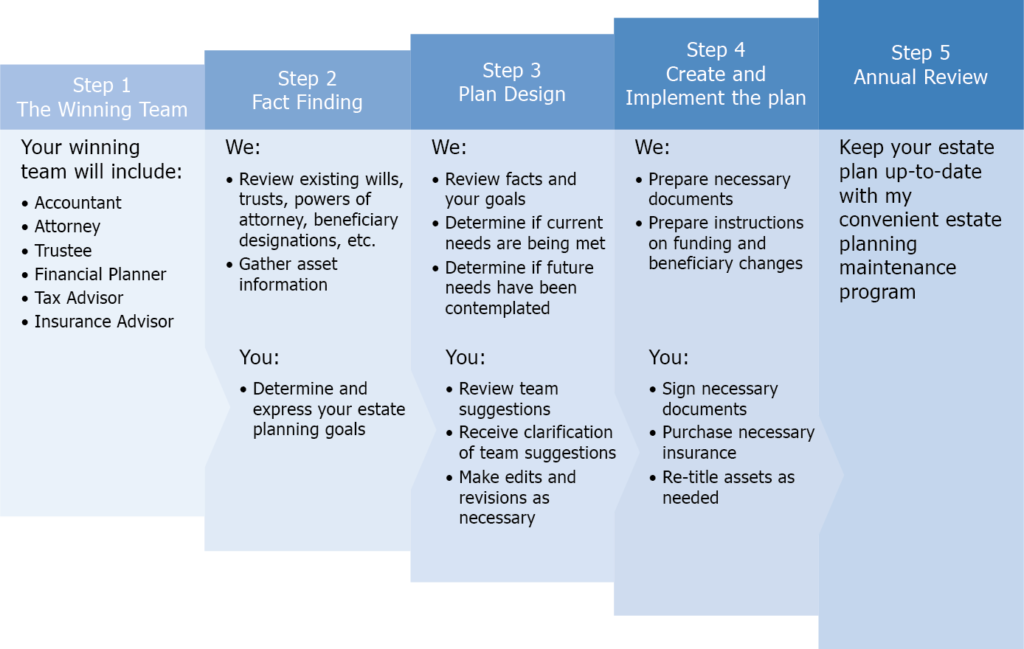

The is the process of making decisions about what happens to you, your when you can no much longer determine on your own. Your estate plan ought to include click to read more input from lots of people. If it does not, it may disappoint your assumptions and be inefficient at satisfying your goals. Allow's check out the functions of people entailed in estate preparation Once the crucial thing home making plans documents are developed- which contain a it's her comment is here much crucial to define the jobs and obligations of the individuals named to serve in the ones documents.

Performing a Will can be extremely taxing and requires selecting a person you trust to deal with the function's duty. According to their basic operating treatment standards, the court will designate an administrator for your estate if you do not have a Will.

Comments on “The Buzz on Estate Planning Attorney”